Commercial Umbrella/Excess coverage can protect your business from limitations in underlying policies and can provide additional limits above those provided in your primary policies. The differences between Umbrella and Excess policies are explained below. Evergreen can help explain the differences and obtain competitive quotes addressing your specific risk categories. To learn more about these coverages, please call Evergreen today.

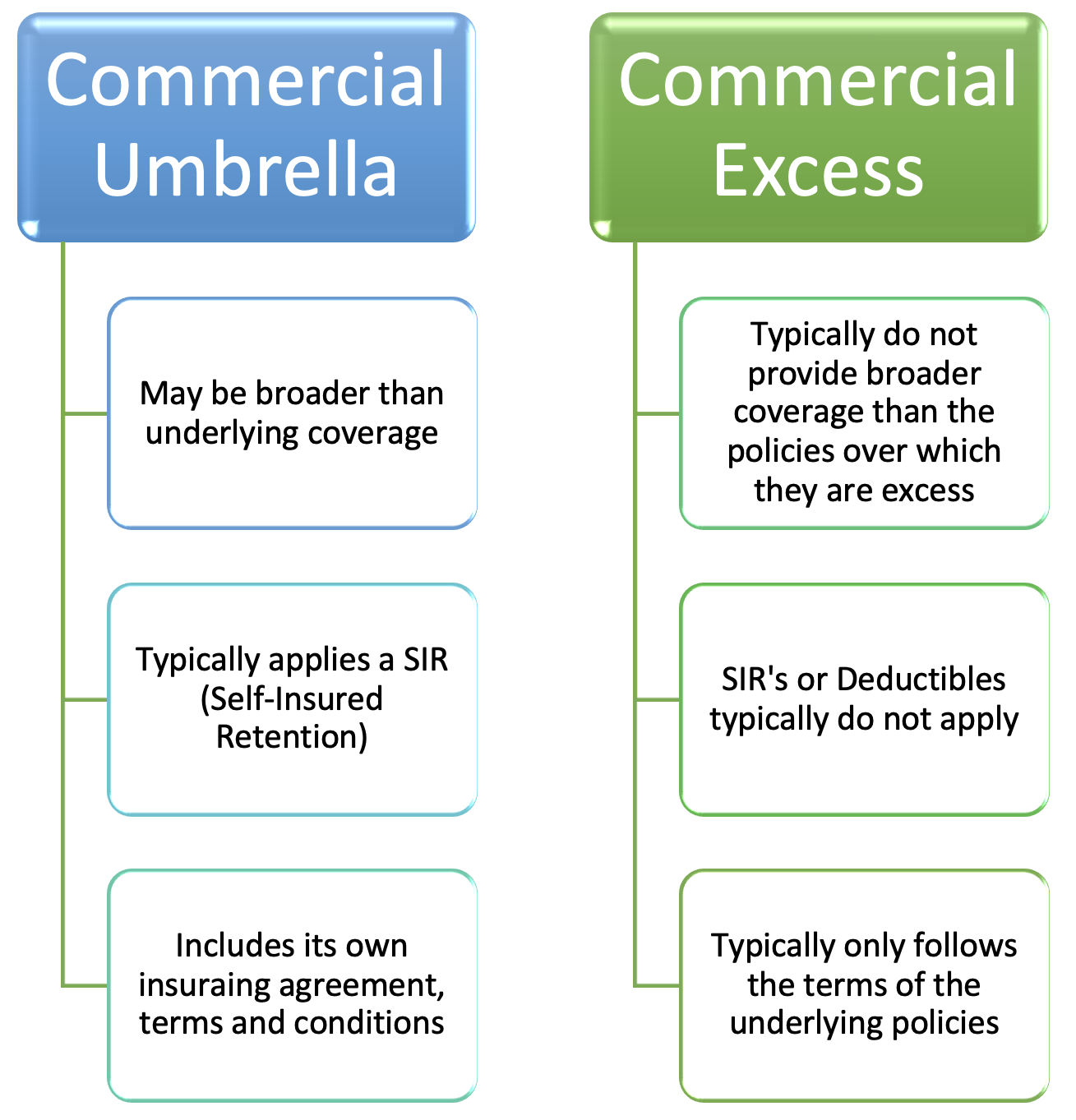

Commercial Umbrella

Lawsuits can impose multi-million-dollar penalties on businesses, far outside the coverage provided by most primary liability policies. As a result, common losses such as vehicle accidents, employment claims, and product injuries can pose a serious financial threat.

Umbrella Liability policies are designed to provide protection against catastrophic losses. They are generally written over various primary liability policies such as business auto, commercial general liability, and employers liability coverage.

Umbrella policies serve three purposes:

- Provide excess limits when the limits of the underlying policies are exhausted by the payment of claims.

- Drop down and pick up where the underlying policy leaves off when the aggregate limit of the underlying policy is exhausted by the payment of claims.

- Provides protection against some claims not covered by the underlying policies, possibly subject to the assumption by the named insured of a self-insured retention (SIR).

Excess Liability

Excess Liability polices provide limits in excess of an underlying liability policy. The underlying liability policy can be, and often is, an umbrella liability policy. These policies are no broader than the underlying liability policy and the sole purpose is to provide additional limits of insurance.

Commercial Umbrella / Excess – Examples of Coverage Differences

Contact us to learn more or start a quote.